The Scenario

A South African manufacturer procures 99–100% pure ethanol (undenatured ethyl alcohol) rather than fully denatured ethanol for use as a solvent or processing input in products such as:

- Cosmetics and fragrances

- Industrial cleaning chemicals

- Surface disinfectants

- Diffuser and extraction bases

- Paint and coatings

- Food processing aids

While the business assumes it is purchasing a standard raw material, pure alcohol in South Africa (SA) is treated as excisable “drinking alcohol” unless the buyer proves otherwise, and SARS applies R292.91 per litre in excise duty on every litre of pure ethanol purchased without the correct licence or bonded storage.

The Problem

The procurement team is buying the pure ethanol as an input solvent/ carrier and does not require it in the final product. This means:

- Is the company is audited by SARS and cannot prove licensed end-use (i.e they do not hold a SARS SOS or User Rebate licence), the pure alcohol will be treated as excisable drinking alcohol

- SARS applies an excise duty ofR292.91 per litre on unlicensed pure ethanol purchases

- As an example, a tanker delivery of 40,000L could expose the company to over R11.7 million in excise alone, before penalties.

- This tax alone is 3–5× more expensive than the ethanol itself, turning a solvent purchase into a massive hidden liability.

- Additional compliance burdens include flammable bonded warehousing, transport permits, audits, and possible licensing delays

This manufacturing business is not just buying ethanol, they’re carrying the cost and regulatory risk of being taxed for drinking alcohol they never needed.

The Solution

If the ethanol is being used as a solvent, carrier, processing aid, or extraction base, and NOT required to remain pure in the final product, the compliant procurement choice is, fully denatured ethanol

It has the same high purity as undenatured, it’s excise-free, licence-free, audit-safe, and no flammable bonded storage is required.

Let’s have a closer look at the compliance differences:

| BEFORE Using Pure/ Undenatured Ethanol | AFTER Using Fully Denatured Ethanol |

| Excise duty of R292.91/L | Zero excise duty |

| SOS or User Rebate License | No SARS license required |

| Flammable bonded warehousing required | No bonded warehousing required (however a flam store is recommended) |

| Risk for misuse or theft | Less misuse/ theft risk |

| Compliance burden (SARS audits etc) | Significantly reduced compliance burden |

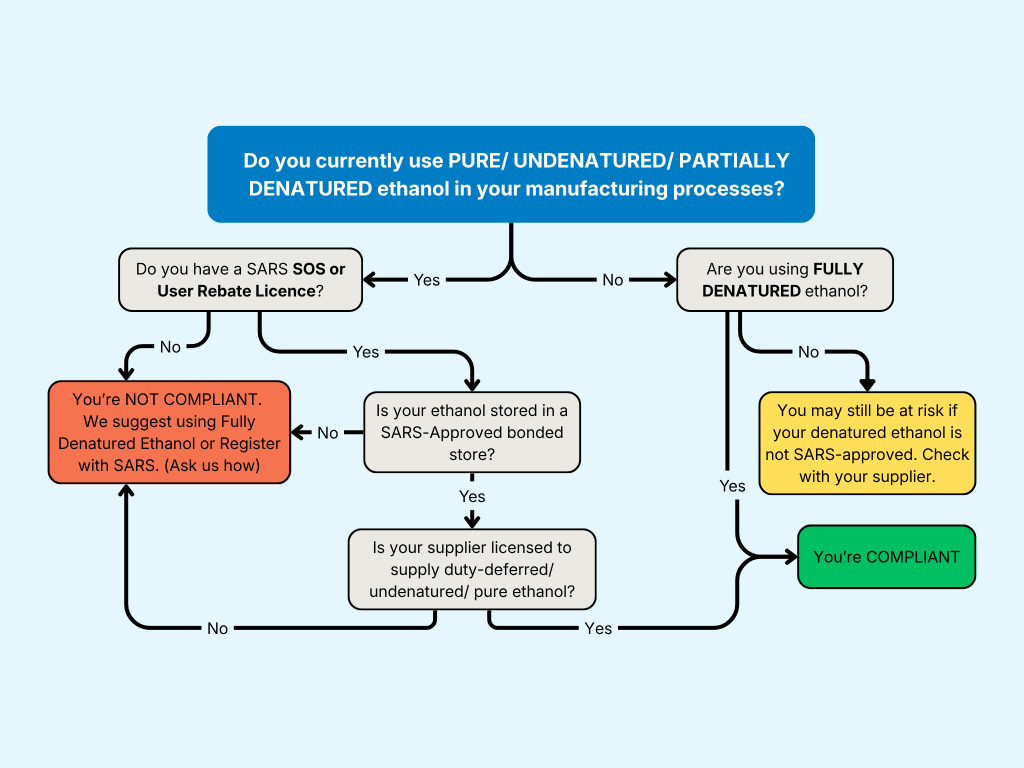

Here’s a decision tree to help you make the right procurement choice:

If your product doesn’t legally require pure alcohol in the end formula, you shouldn’t be paying drinking-alcohol tax on it.

Savvy procurement teams are switching to fully denatured, non-excisable ethanol, and Enterprise Ethanol is the partner built for exactly that shift.

Whether you need fully denatured ethanol blends or pure undenatured ethanol for specialised licensed applications, Enterprise Ethanol is the partner that protects your business, your costs, and your compliance. Get in touch with us to discuss how we can help you.